OIL PEAK

World’s energy

value has never been so huge as it is now. The use of commercial energy now

exceeds 200 million barrels of oil equivalent (BOE) each day and it is the

world’s largest industry. Energy is the world’s equivalent of oxygen to the

human body. Now it seems that the world is going to face serious problem with

peaking and decline of oil production. The peak of oil discoveries was reached

in the 1960s. This peak has to be followed by a peak in production, since we

can only produce what has been found before. Peak production was reached in

many countries e.g. in the USA (1970). Recent "members“ joining the club

of 50+ countries with declining production rates are UK (1999), Australia

(2000), Oman (2000) and Norway (2001).

World’s energy

value has never been so huge as it is now. The use of commercial energy now

exceeds 200 million barrels of oil equivalent (BOE) each day and it is the

world’s largest industry. Energy is the world’s equivalent of oxygen to the

human body. Now it seems that the world is going to face serious problem with

peaking and decline of oil production. The peak of oil discoveries was reached

in the 1960s. This peak has to be followed by a peak in production, since we

can only produce what has been found before. Peak production was reached in

many countries e.g. in the USA (1970). Recent "members“ joining the club

of 50+ countries with declining production rates are UK (1999), Australia

(2000), Oman (2000) and Norway (2001).

The production pattern during the life of any oil region can be divided into three phases: continual or increased production, flat (peak) production and decline of production. The production peak of each field is an inevitable fact. Today almost all large oil fields have already passed their max. production and are in decline. Many geologists who study world oil reserves vs. production believe that world oil supply will soon get into the turning point towards an irreversible decline. According to Dr. Campbell, who spent decades working as an international exploration geologist for major oil companies, world oil discovery peaked in the 1960’s and has declined steadily since. World is facing the situation when we produce four barrels for every one we discover. Clearly, this is an unsustainable situation since long-term discovery and production must be in balance to some degree. There is an imminent threat of oil peak ahead of us. But peak does not mean the world will run out of oil. Peaking does mean growth is over and steady decline is ahead.

PAST PEAKS

The geologist King Hubbert (former employee of Shell) predicted as early as in

1956 the peak of the US oil production to be reached around the year 1970. This

prediction was widely ignored at that time but later it turned out to be

correct. US oil supply peaked in 1970.

North Sea oil peaked in 1999 to 2001. Oil production in FSU (former Soviet Union) peaked in 1988 and recent growth is considered as the capturing of oil left behind. Iran’s great oil fields peaked in the 1970s. Most of them now produce 15% to 30% of peak rates. Oil production has peaked in more than 50 oil producing countries, including the USA and Great Britain. Conventional oil in Canada is also in steady decline now. China, which is just second behind to the US in oil consumption, was a net exporter of oil until 10 years ago and now imports almost one third of its own oil needs.

And the natural gas is peaking as well. North American natural gas peaked in 2001. Gas supply also peaked in Indonesia, Netherlands, U.K. and probably Russia.

USA

The production peak was reached in the USA in 1970. Growing oil production in

Alaska in the following years could only compensate for the decline of the old

fields for a short while. High oil prices stimulated enormous activity in the

early 1980s in order to bring new wells into production. This resulted in a

slight increase in the production of the “Lower 48” states. Nevertheless within

a few years the production then started to decline again at even higher rates

than before. The long-term decline trend was approaching the values one would

have expected from the experience of the 1970s. Alaska reached its peak more

than ten years ago. Texas passed its maximum thirty years ago. Today, Texas

produces no more than it did in the 1930s. The other states passed peak

production in the early 1970s and are declining year by year. Average oil

production per well has also declined. In Texas to about 6 barrels per day,

while in Pennsylvania – where the oil boom started 140 years ago – it is even

lower. These production rates can be compared with the generation of renewable

energy: an average oil well in Texas produces about the same amount of energy

as might be provided in the form of thermal energy by solar collectors of 1,800

m2 in size, i.e. less than 45 meters square.

UK

Oil production in UK peaked in 1999. The production of all the big fields has

been declining for many years, but for the first time in the year 2000 bringing

new fields into production could not compensate this decline. Since then total

production has also been decreasing. In the year 2000 production was 8 % lower

than in 1999; the year 2001 brought another reduction of 10 % compared to the

year before. The fact recognized also by Michael Meacher former UK environment

minister (1997 – 2003) who expressed his worries about upcoming oil peak in the

article which appeared in Financial Times (Jan 05, 2004). „Four months ago,

Britain's oil imports overtook its exports, underlining a decline in North Sea

oil production that was already well under way. North Sea oil output peaked at

about 2.9m barrels per day in 1999, and has been predicted to fall to only 1.6m

bpd by 2007. Today the world enjoys a daily production of 75m bpd (barrels per

day). But to meet projected demand in 2015, we would need to open new oilfields

that can give an additional 60m bpd. This is frankly impossible. It would

require the equivalent of more than 10 new regions, each the size of the North

Sea. The production of non-conventional crude oil has already been initiated at

enormous cost in Venezuela's Orinoco belt and Canada's Athabasca tar sands and

ultra-deep waters“.

What happened with the North Sea oil? Evidently giant and medium sized

fields declined fast and have not been compensated by the new discoveries.

Almost all new finds were small. Important thing is that that only few believed

the UK could peak. So the question is if the North Sea lesson will be a global

case study.

MIDDLE EAST

Ghawar is the world’s largest oil field, which was discovered in Saudi Arabia

in 1949. This oil filed accounts for the production of 55 to 60 percent of all

Saudi oil. Shaybah, Saudi Arabia’s last giant oil field was discovered in 1967.

The fear is that these elder oil fields may have already peaked and their

production loss will never be compensated by the new discoveries.

The world has

assumed that Middle East oil is possibly inexhaustible, but major declines in

previously great oilfields have already occurred. The great Iranian oil fields

are typical examples. Recent Oman’s surprising production declines were also

unexpected. Peaking has always been a surprise. Russian peaking came suddenly.

Simmons & Company predicted North Sea oil peaked (1997-2000). Only few

thought that North American natural gas peak production was possible. Middle

East oil peak will be the biggest surprise. When Saudi Arabia’s oil output

peaks, the world has also peaked. Despite the fact that “peaking” has generally

been accepted a years after the event, oil and gas fields do peak, regardless

of where they are located.

The world has

assumed that Middle East oil is possibly inexhaustible, but major declines in

previously great oilfields have already occurred. The great Iranian oil fields

are typical examples. Recent Oman’s surprising production declines were also

unexpected. Peaking has always been a surprise. Russian peaking came suddenly.

Simmons & Company predicted North Sea oil peaked (1997-2000). Only few

thought that North American natural gas peak production was possible. Middle

East oil peak will be the biggest surprise. When Saudi Arabia’s oil output

peaks, the world has also peaked. Despite the fact that “peaking” has generally

been accepted a years after the event, oil and gas fields do peak, regardless

of where they are located.

OIL PEAK EVERYWHERE

There are more and more countries which has been hit by the peak oil and falling production. Worldwatch Institute in their study State of the World 2005 observed that oil production is in decline in 33 of the 48 largest oil-producing countries. There are more other smaller countries which also passed their peak oil production. Following figure shows the most important oil-producing countries behind peak.

OIL DISCOVERIES

The crucial question is: Are the new supplies large enough to replace declines

in existing production? Probably not. The world used four times as much oil as

was newly found in 2008. The rate of discoveries of worldwide oil reserves is

steady declining. In 2000, there were 16 large discoveries of oil, eight in

2001, two in 2002, and none last year. The last two super giant oil fields

found were Prudhoe Bay (1968) with 15 to 20 Billion barrels and Samotlar (1967)

with the same volume of oil found. Moreover 95% of new oil discoveries are

small fields.

Descending Size Of Giant

Oilfields

|

|

Number Of Discoveries |

Average Current Production (Per Field) |

|

Bbls/Day |

||

|

Pre - 1950s |

19 |

557 000 |

|

1950s |

17 |

330 000 |

|

1960s |

29 |

242 000 |

|

1970s |

24 |

236 000 |

|

1980s |

15 |

176 000 |

|

1990s |

11 |

126 000 |

Total oil discoveries (excluding North America) for 2002 fell by 35 percent,

from 10.1 billion barrels in 2001 to 6.6 billion barrels. With total

world oil production for the year at 26.7 billion barrels, more than four

barrels were produced for every new barrel found.

Source : ASPO Newsletter No. 38 (Feb. 2004).

The year 2003 seems to be the first year since the beginning of the modern oil industry to have recorded no large oil discoveries at all. According to a recently published review by consultants IHS Energy. "One of the most significant concerns was that 2003 didn't produce large, unpredicted finds." Chris Skrebowski, Editor of Petroleum Review, described the year's exploration results as "little short of horrifying" noting that "We would probably have to go back to the early 1920s to find a year when fewer large oil discoveries were made."

Total oil discoveries from new fields have replaced only 40 percent of production since the mid-1990s. And all this cost huge amount of investment. Since 2001, the 10 largest oil companies together spent more on exploration than the present value of the discoveries they made. And natural gas discoveries follow the same pattern. In 2002 discoveries failed to replace annual production for the second year running.

SIGNS OF THE IMMINENT PEAK

PRODUCTION

There are several facts supporting the claims that the world is facing imminent

threat of the oil peak:

![]() The oil

industry is spending huge money and using all available technologies to find

new oil in unfavorable areas (like Arctic region, Deep Sea). This could be seen

as the industry’s admission of the fact that ever less oil is found at other

easier accessible places.

The oil

industry is spending huge money and using all available technologies to find

new oil in unfavorable areas (like Arctic region, Deep Sea). This could be seen

as the industry’s admission of the fact that ever less oil is found at other

easier accessible places.

![]() More oil

producing countries are reaching their peak of production in spite of very

favorable economic conditions like high prices of oil.

More oil

producing countries are reaching their peak of production in spite of very

favorable economic conditions like high prices of oil.

![]() Oil industry

spent billions of dollars just to keep production flat. Survey covering 145

companies (1996 - 2000) shows that 410 billion USD was spent for net production

decline. Big five oil companies spent 150 billion USD during 1999 – 2002 for 4%

growth (600,000 bpd).

Oil industry

spent billions of dollars just to keep production flat. Survey covering 145

companies (1996 - 2000) shows that 410 billion USD was spent for net production

decline. Big five oil companies spent 150 billion USD during 1999 – 2002 for 4%

growth (600,000 bpd).

![]() Combined

production peak of all countries outside OPEC occurred around the year 2000.

Combined

production peak of all countries outside OPEC occurred around the year 2000.

![]() Non-OPEC,

non-FSU supply has been flat for 7 years

Non-OPEC,

non-FSU supply has been flat for 7 years

![]() 120 giant

fields (mostly old) make up 47% of total world oil supply (14 old oil fields

make up 20%).

120 giant

fields (mostly old) make up 47% of total world oil supply (14 old oil fields

make up 20%).

![]() BP downscaled

its production goals three times within the year 2001.

BP downscaled

its production goals three times within the year 2001.

![]() Several large

oil companies are changing their reporting patterns and publish only their

total output with combined financial results for oil and gas. This policy

obscures the change in the production portfolio - a declining oil business and

a growing share of the gas production.

Several large

oil companies are changing their reporting patterns and publish only their

total output with combined financial results for oil and gas. This policy

obscures the change in the production portfolio - a declining oil business and

a growing share of the gas production.

![]() High-ranking

managers of Exxon (largest private oil and gas company) made several speeches

in which they informed that the whole industry is facing new and fundamental

problems. Exxon has also published a graph, which shows the historical records

of oil discovery which first was published by Colin Campbell and Jean

Laherrère. It shows the fact that peak discovery took place in the 1960. Exxon

admits the fact that discoveries declined in the last two decades despite

increased oil prices (The Future of the Oil and Gas Industry, Harry J.

Longwell, World Energy Vol. 5, No. 3, 2002).

High-ranking

managers of Exxon (largest private oil and gas company) made several speeches

in which they informed that the whole industry is facing new and fundamental

problems. Exxon has also published a graph, which shows the historical records

of oil discovery which first was published by Colin Campbell and Jean

Laherrère. It shows the fact that peak discovery took place in the 1960. Exxon

admits the fact that discoveries declined in the last two decades despite

increased oil prices (The Future of the Oil and Gas Industry, Harry J.

Longwell, World Energy Vol. 5, No. 3, 2002).

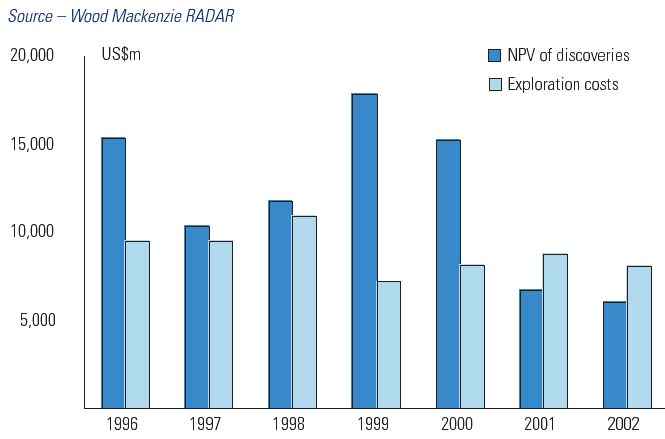

Problems with exploration

Professor Kjell Aleklett, president of ASPO:

For over 30 years, Wood Mackenzie has been providing analysis and strategic advice

to the world’s leading energy companies. During this time they have developed a

unique and unrivalled foundation of knowledge within the Energy Industry. They

are specially known for their analysis of the oil industry. Now in January 2004

they have released an horizon analysis titled “New thinking needed for

exploration?” The conclusions are with data since the mid 1990s:

![]() Only 3 out of 10

exploration wells have been successful.

Only 3 out of 10

exploration wells have been successful.

![]() Excluding the

giants of the deep-water zenith and Kashagan (1999 and 2000). The average

discovery size has been around 50 million barrels. This should be compared with

the daily production of 75 million barrels. Summing up the discoveries

for 2003 it looks to be around 20 million barrels per day. We are indeed

cutting a large piece of the reserve cake.

Excluding the

giants of the deep-water zenith and Kashagan (1999 and 2000). The average

discovery size has been around 50 million barrels. This should be compared with

the daily production of 75 million barrels. Summing up the discoveries

for 2003 it looks to be around 20 million barrels per day. We are indeed

cutting a large piece of the reserve cake.

![]() The average value

of discoveries has fallen. This is in accordance with the predictions of

Uppsala * Hydrocarbon Depletion Study Group, www.isv.uu.se/uhdsg.

The average value

of discoveries has fallen. This is in accordance with the predictions of

Uppsala * Hydrocarbon Depletion Study Group, www.isv.uu.se/uhdsg.

![]() The average value

of discoveries has fallen.

The average value

of discoveries has fallen.

![]() The majors

performed disproportionately well in 1999 and 2000 but less well before and

since.

The majors

performed disproportionately well in 1999 and 2000 but less well before and

since.

The summary of the report is that new field exploration has not replaced oil reserves.

One of the very interesting findings of the report is that the ten largest

western major oil companies during 2001 and 2002 lost money on

exploration.

Wood Mackenzie: “We believe that exploration cannot continue to be the main

growth engine for the majors as it has in the past.”

FUTURE DEMAND

Worldwide demand for oil is far stronger than many analysts believe. Even at

today’s oil price of nearly 35 USD we can see few efforts at conservation or

move towards renewable energy sources. In fact, many countries (China being the

best example) are experiencing record oil demand. Today two billion people

still use no oil and another 3 billion use very little oil. So the question is:

How solid is our energy future? Where will China and the others get its oil? China

was a net oil exporter during 1970s and 80s. It became a net oil importer in

1993 and its dependence on imported oil is steady growing. China, second

largest world oil consumer, currently imports 32% of its oil and is expected to

double the amount until 2010. A report by the International Energy Agency

predicts that by 2030, oil imports of China will equal imports of the USA

today.

There is no doubt that huge increases for oil imports will take part in China,

India, and other developing nations and that the 21st century will need far

more oil and gas if the world development will be based on fossil fuels like

oil and gas. Population is growing and current oil and gas use is still limited

to the “chosen few.” So the question is: How the demand will be met by the

supply?

NEW FRONTIERS

Fighting decline curves is the greatest challenge for the new technology, new

regions and non-conventional oil. Today it seems that if offshore and

non-conventional oil and gas cannot grow fast, the future of these fossil fuels

is grim. Oil recovery from ageing fields utilizing new technology is becoming

more and more important. New measures are often mentioned as a viable source of

increased future oil recovery and as a reason to blame forecasters for being

too pessimistic regarding future oil production. It is true that these measures

are widely used and have the potential to increase the oil production rate. But

the results of new technologies seem to lead only to faster declines. An

example - The Yates field - one of the largest US fields, which was found in

1926 in Texas and was exploited since 1929. From its peak production in 1970

the production rate has declined by more than 75%. In 1993 the new technology

of hot steam and chemicals injection was introduced to increase the production.

This measure was successful for less than 5 years. The decline afterwards was

even steeper, exceeding 25 % per year instead of 8.4 % as before. Today the

production rate is even below the level it would be without these measures.

Result - new oil field technology led to high rates of decline (15 to 50% a

year).

Another example with multi billion-dollar technology of gas injection to boost old fields is Oman’s Yibal oil field. The new technology was introduced in 1990 - after 30 years of water injection and pressure maintenance. In 1997 Yibal reached the peak. In 2001 production declined by 65%. The collapse was a total surprise for many experts.

NON-CONVENTIONAL OIL

Quite often we can hear the claims that the depletion of conventional oil

supply will be offset by the production from non-conventional sources, like oil

from tar sands (heavy oil). Scientists acknowledge abundant non-conventional

oil. But the oil production is costly and environmentally unfriendly. Oil sands

are now and will be important for some countries like Canada as a long-term

source of energy and income. But they will hardly be a source of oil as are the

world's oil wells today.

NATURAL GAS

Natural gas faces similar uncertainty as the oil. For years, most natural gas

was flared as the waste product. Now many experts believe that natural gas will

be the energy of the future - or at least of the 21st century. But the gas is

fossil fuel and like oil it will peak as well. Conventional natural gas in the

USA peaked in mid 1990s, and is now down to 20% - 30%. This decline reflects US

oil decline more than 30 years ago. More important for the world economy is

that 60% of current world gas base (US, Russia, Canada, UK) is in decline. It

is also interesting to see worldwide gas discoveries peaking only a few years

later than oil did, though worldwide interest in natural gas business increased

over the last two decades.

CRISIS OR A NEW START

It seems that the world has to have more energy and preferably needs cheap oil

to grow its GDPs. Global economy has enjoyed stable and low oil prices for

almost all of the past two decades but oil peak could make an ultimate end to

this.

The world already experienced the

shock of shortage of cheap oil. During oil crisis in 1973 price of oil rose

from 3 USD to 5 USD per barrel on (Oct. 19th). By Christmas Eve it reached

almost 12 USD. It was described as the “The worst crisis to the free world

since World War II.” (Henry Kissinger in his Memoirs). All what happened was

just a 5% imbalance between demand (great) and supply (low). Evidently if

supply ever becomes even 1% less than demand, a crisis is triggered and if it will

last longer the impact on economy will be immediate and drastic. Oil peak seems

to be the ultimate trigger for another world economy crisis.

The world already experienced the

shock of shortage of cheap oil. During oil crisis in 1973 price of oil rose

from 3 USD to 5 USD per barrel on (Oct. 19th). By Christmas Eve it reached

almost 12 USD. It was described as the “The worst crisis to the free world

since World War II.” (Henry Kissinger in his Memoirs). All what happened was

just a 5% imbalance between demand (great) and supply (low). Evidently if

supply ever becomes even 1% less than demand, a crisis is triggered and if it will

last longer the impact on economy will be immediate and drastic. Oil peak seems

to be the ultimate trigger for another world economy crisis.

Experts predict that oil production will peak and that crisis will come

again when half of the oil reserves will be used. This prediction is

quantitatively unquestionable. But the question of when the peak will occur

depends on uncertain numbers. The so-called proven oil reserves as reported by

various countries and companies are often just guesses and probably not honest

guesses. Statistics shows that oil reserves have almost continuously increased

for more than 40 years, though each year about 25 Gb or 2 % of known reserves

are removed by production. Oil companies frequently publish information and

scientific studies on the future availability of oil. But the oil industry has

a natural financial interest in doing this:

![]() Announcement of

diminishing resources could have negative impact on consumers, shareholders and

investors (redirection of their investments into new business).

Announcement of

diminishing resources could have negative impact on consumers, shareholders and

investors (redirection of their investments into new business).

![]() For the oil

business is the best if consumers and shareholders would stay loyal to oil even

at declining production rates and rising prices. This would bring the highest

earnings for them at minimum costs. So the best method is to convince the

consumer that any current problems are only temporary – and thus to keep them

dependent on oil even in worsening times.

For the oil

business is the best if consumers and shareholders would stay loyal to oil even

at declining production rates and rising prices. This would bring the highest

earnings for them at minimum costs. So the best method is to convince the

consumer that any current problems are only temporary – and thus to keep them

dependent on oil even in worsening times.

ECONOMICAL VS. GEOLOGICAL

POINT OF VIEW

Today's discussion of future oil and gas supply is dominated by two opposing

positions. Economists base their knowledge mainly on information coming from

the oil companies. They usually argue that market mechanisms will guarantee

future discoveries and production rates. Many of them believe that also in the

long-term supply shortages can be avoided. According to the economical theory

price increases will happen only for short times and market forces and the new

technology will lead the new equilibrium between supply and demand.

In contrast to them geologists base their knowledge more on the physical and

mainly geological view. They argue that the historical peak in discoveries has

to be followed by the peak of production. Several of these analysts have many

years of personal experience in oil exploration with large oil companies. ”Geologists

look for oil, engineers produce oil, and economists sell oil. Beware of

economists who tell you how much is there.“ Colin J. Campbell, geologist.

OIL SHORTAGE AFTER 2015?

According to many experts global oil supplies could have a problem with meeting

growing demand after 2015. While it is expected that several new productions

will enter the market over the next, the volumes expected from these projects

thereafter are likely to fall well below requirements. All known projects

with estimated reserves of over 500 million barrels of oil and the claimed

potential to produce over 100,000 barrels per day were analyzed. These

projects account for about 80 percent of the world's oil supplies. The volumes

of new production beyond 2015 will likely fall short of the combined need to

replace lost capacity from depleting older fields and satisfy continued growth

in world demand.

Estimates of the date of peak global production vary with some experts saying it already may have occurred as early as the year 2005 (conventional oil). Nevertheless the oil peak is inevitable and it does not matter if it will come in this decade or the next. Oil is fossil fuel and peak production is the fate of all of fossil fuels. The crucial question is if the world has the “Plan B” (or trap door) if oil and gas peak and their prices will inevitably rise. Now it seems that if the world ran short of oil and gas, the future forever growing population could be quite bad.

RENEWABLE ENERGY IS THE

ANSWER

In 2008, oil demand reached 84 million barrels per day. Natural gas demand

exceeded 45 million BOE/d (barrels of oil equivalent per day). Together they

account for 60% of a 3 trillion USD energy business or 1.8 trillion USD of

value per year. According to a report from the International Energy Agency the

world's increasing demand for oil will require total investments of over 3

trillion USD - or more than 100 billion USD a year by 2030. Estimating that

worldwide demand for oil would reach 120 million barrels a day by 2030, up from

80 million barrels now, the agency's World Energy Investment Outlook 2003

claims that three quarters of the projected investment will be needed to offset

the decline in production from existing fields and the remainder will be needed

to meet rising demand. Trillions of dollars for shrinking supplies and with

inevitable economy crises ahead.

If we are looking far into the future we can say that the world needs the energy for at least 10 billion people. At minimum we need 10 Terawatts (150 MBOE/day) from clean and sustainable energy sources by 2050. Do we have the solution for this problem? Yes we do. Renewable energy is the answer. There is 165,000 TW of sunlight hitting the earth every day. There is technology utilizing this source in place. What is needed is the political leadership and willingness to redirect the money allocated for fossil fuels towards renewables. We know that we have to do this. We need the revolution in energy sector. So the question is: What we are waiting for? An energy crisis? Global climate change? Wars for the last oil reserves? Or just a new way of thinking and a new administration?